Elevators and Escalators from CHINA to The ASEAN–China Free Trade Area (ACFTA)

Elevator Components from CHINA to The ASEAN–China Free Trade Area (ACFTA)

Elevator Spare Parts from CHINA to The ASEAN–China Free Trade Area (ACFTA)

Elevator Traction Machines from CHINA to The ASEAN–China Free Trade Area (ACFTA)

China Certificate of Origin – What An Importer Should Know

Certificate of Origin, also known as C/O or CO, is a shipping document which is used for certification that the products exported are wholly obtained, produced or manufactured in a particular Country.

Why important?

This shipping paper is intended solely to prove the origin of goods in order to satisfy customs or trade requirements. Now it can be served as:

- Reference for trade statistics

- Evidence of goods` inner quality or settlement of exchange

- Important tool for deciding on tariff treatment

Most countries now are applying different customs duty rate upon imported commodities from different countries. In the specific conditions, import countries will provide different tariff treatment according to the C/O. While in some cases, tariff duty rates can make up a large part of the total laned cost.

When needed?

Tariff Concession Certificate | duty-free policy | with zero tariff treatment under ASEAN-CHINA FREE TRADE AREA

Certificates of Origin should only be issued when they are actually needed, for example, in the following circumstances:

- To meet customs requirements in the importing process

- The customer/buyer/importer (consignee) requires it

- To meet `quota` or statistical requirements imposed by the importing country

- To comply with the banking or trade finance requirements ( L/C, letters of credit)

Check with your local Customs authority to see if you`ll benefit from getting a proper C/O. If yes, request CEP Team apply it for you. It`s an option at extra cost

Attention: For some countries such as Egypt/Saudi Arabia/Syria, a C/O is a must, no matter whether you can benefit from the duty discount.

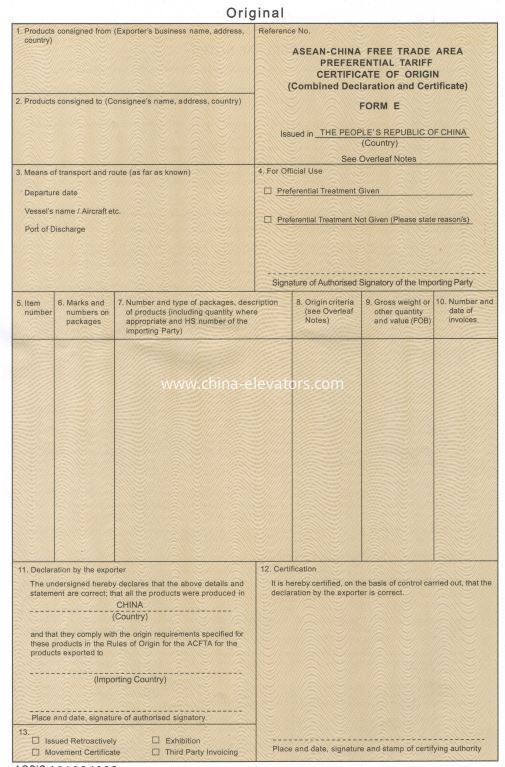

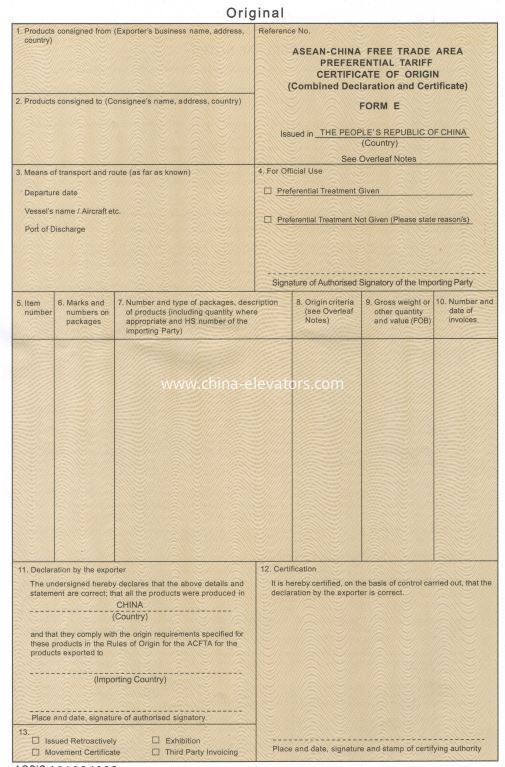

ASEAN-CHINA FREE TRADE AREA

PREFERENTIAL TARIFF

CERTIFICATE OF ORIGIN

(Combined Declaration and Certificate)

FORM E

Issued in THE PEOPLE'S REPUBLIC OF CHINA

Applied to following countries: Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, Philippines, Singapore, Thailand and Vietnam.

The ASEAN–China Free Trade Area (ACFTA), also known as China–ASEAN Free Trade Area is a free trade area among the ten member states of the Association of Southeast Asian Nations (ASEAN) and the People's Republic of China. The initial framework agreement was signed on 4 November 2002 in Phnom Penh, Cambodia, with the intention to establish a free trade area among the eleven nations by 2010. The free trade area came into effect on 1 January 2010. The ASEAN–China Free Trade Area is the largest free trade area in terms of population and third largest in terms of nominal GDP.

ASEAN members and the People's Republic of China had a combined nominal gross domestic product of approximately US$6 trillion in 2008 The free trade area had the third largest trade volume after the European Economic Area and the North American Free Trade Area.

| Brunei Darussalam | Bandar Seri Begawan | 5,765 | 490,000 | 19.7 | dollar | Malay |

| Burma (Myanmar) | Naypyidaw | 676,578 | 50,020,000 | 26.2 | kyat | Burmese |

| Cambodia | Phnom Penh | 181,035 | 13,388,910 | 11.3 | riel | Khmer |

| Indonesia | Jakarta | 1,904,569 | 230,130,000 | 511.8 | rupiah | Indonesian |

| Laos | Vientiane | 236,800 | 6,320,000 | 5.4 | kip | Lao |

| Malaysia | Kuala Lumpur | 329,847 | 28,200,000 | 221.6 | ringgit | Malay, English |

| Philippines | Manila | 300,000 | 100,981,437

(2015) | 166.9 | peso | Filipino, English |

| Singapore | Singapore | 707.1 | 4,839,400

(2007) | 181.9 | dollar | Malay, Mandarin, English, Tamil |

| Thailand | Bangkok | 513,115 | 63,389,730

(2003) | 273.3 | baht | Thai |

| Vietnam | Hanoi | 331,690 | 88,069,000 | 89.8 | đồng | Vietnamese |

| People's Republic of China | Beijing | 9,640,821 | 1,338,612,968

(2009) | 4,327.4 | renminbi | Mandarin |

The free trade agreement reduced tariffs on 7,881 product categories, or 90 percent of imported goods, to zero. This reduction took effect in China and the six original members of ASEAN: Brunei, Indonesia, Malaysia, the Philippines, Singapore and Thailand. The remaining four countries will follow suit in 2015. The average tariff rate on Chinese goods sold in ASEAN countries decreased from 12.8 to 0.6 percent on 1 January 2010 pending implementation of the free trade area by the remaining ASEAN members. Meanwhile, the average tariff rate on ASEAN goods sold in China decreased from 9.8 to 0.1 percent.

The six original ASEAN members also reduced tariffs on 99.11 percent of goods traded among them to zero.